Tax season has my family and I working real hard to make sure we get every dollar we deserve. Today’s chapter will talk about harvesting your capital losses so you can deduct them from your taxable income.

A big question is, can I still claim losses even though I take the standard deduction? The answer is yes. Even if you file only with the standard deduction you can still claim any capital losses on your tax return.

Most tax software will do this for you automatically when you import your 1099-B or similar.

*All must be done before December 31st. So for example December 31st, 2023 would be the cutoff sale date for 2023 taxes filed in 2024.

Rules:

- You cannot claim more than $3,000/yr in losses.

- You can roll over additional losses into next years return, with the $3,000 cap still in place.

- You cannot claim losses on investments you sell then buy back in a 30 day period. This is an IRS rule called a “Wash Sale“.

- Last day to sell is before December 31st of the tax year. Anything sold after that will have to be claimed on next years return.

- You can only claim this on investments done in a taxable account. This excludes IRAs, and 401(k) losses.

- You must have a realized loss (executed the sale and not pending). This means that unrealized gains/losses don’t count until the sale executes.

What constitutes a capital loss?

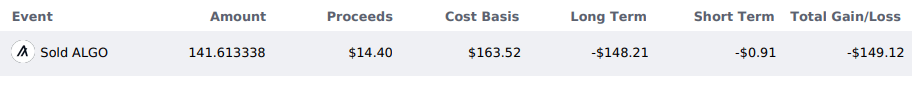

A capital loss is defined when sale proceeds are lower than the cost basis. This means that you sold your investment for less than what you bought it for. For example,

This can be anything from an individual stock, ETF, and even cryptocurrency.

Strategy

Don’t just sell your losers at the end of the year in hope for a tax break. Think about why you’re selling your losing investment. If you want to sell and buy a better looking company, then this can be a good reason to harvest the losses and move your money to something greater. All while taking advantage of the tax code :).

Some people use this same strategy to move their losses from ETFs to other “similar” ETFs. Remember the rule about the wash sale. You CANNOT buy the same investment, but you CAN harvest losses and buy a “similar” investment. The higher your tax bracket the more you benefit from harvesting losses.

Bottom Line

Although harvesting losses doesn’t result in a “refund” it does however lower your taxable income. This can be a huge benefit and result in paying less in taxes the higher your tax bracket is. Talk to your CPA if you’re unsure on how to harvest losses. They can help look at your portfolio and help you maximize your losses to make the most out of this or next tax season. Remember to do this timely you have to realize all losses before December 31st otherwise you will have to claim them for next years tax return.

Thank you for reading. Good luck with your taxes and see you next Sunday,

– Pablo