When does it make sense to finance?

Have you ever been in a situation where you have the capital available to pay something off, but you’re not sure if you should? Maybe it could be a small car note or a personal loan.

When does it make sense to finance:

- If your interest rate is below what you would earn in a Savings Account.

- You have a promotional low rate.

- You locked in a fixed period and you’ll be charged early payment penalties.

- You need extra money for an emergency.

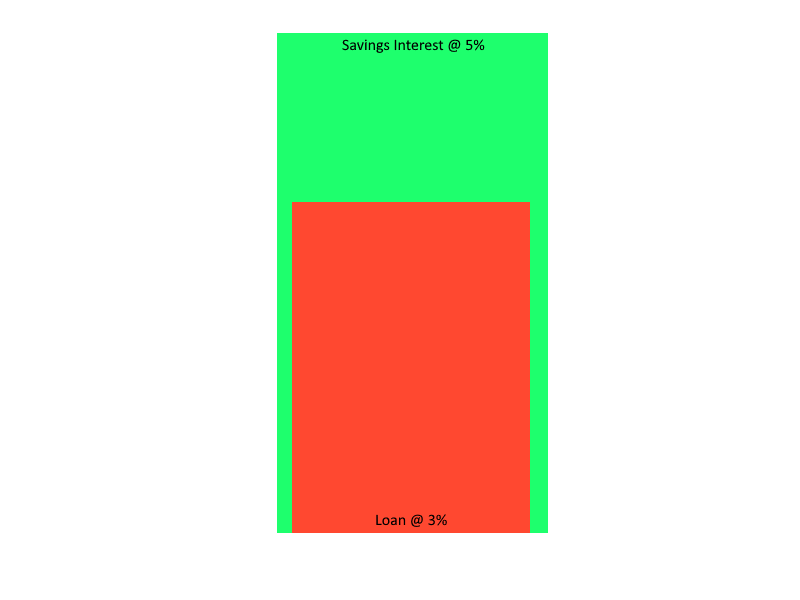

The typical rule for me is, if you can earn more with your money somewhere else than you are charged in fees or interest from a loan you should keep financing. Think about it, if done correctly you are being paid to borrow money from someone else.

If you’re borrowing money from the bank for a car @ 3% but your high yield savings account pays 5%, you’re being paid 2% to borrow money.

Won’t holding balances hurt my credit?

Yes and no. Although in the long run your credit and payment history will increase since the “longer” you hold a balance you are proving you actually pay people back. It might temporarily hurt your score if you have relatively young credit with high balances and not much available credit.

During these times you should consider if holding balances is beneficial to you. Paying off balances early won’t magically make your score increase, but it should help if you have high balances with low available credit. You can learn more about this in the previous chapter.

Bottom Line

Borrowing money isn’t a bad thing! Use debt to your advantage. Sometimes you can be smart with it and make a profit. The banks do it every day, why can’t you?

Thank you so much for reading and see you again next Sunday,

– Pablo