Big Banks Control My Scores?

Having a good credit score is a successful way of proving that you can pay back your debts. It rewards good borrowers by giving them a discount on interest, access to premium credit cards, and larger lines of credit. Many people seem to disagree with this system and calling it “in favor of banks”. Although this system is quite literally built to defend lenders to see who is the most qualified to borrow money and most likely to pay it back.

Credit is monitored by credit reporting agencies. The big 3 are Experian, Equifax, and Transunion.

How does it work?

The 3 bureaus all use a variation of FICO. There are “10” variations of the score all used for different purposes. For example FICO Bankcard Score is more sensitive on how you manage your credit cards and is widely used when you apply for new credit cards. As opposed to FICO 2 (Experian RISK MODEL v2), FICO 4 (Transunion FICO RISK SCORE 04), FICO 5 (Equifax Beacon 5.0) which are widely used for mortgages.

info: Investopedia

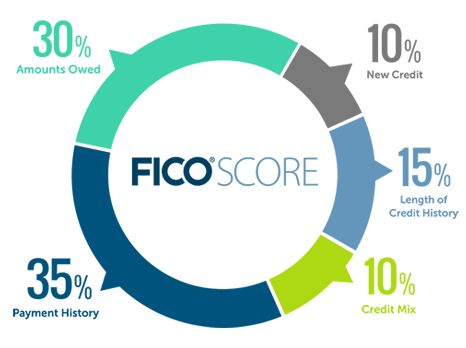

FICO one of the biggest scoring systems used by the 3 large bureaus interpret scores like this.

- Payment History – 35%

- Amounts Owed – 30%

- Length Of Credit History – 15%

- Credit Mix – 10%

- New Credit – 10%

Information and graphics from FICO

Payment History –

This shows that you pay your debts off on time. Goes hand in hand with credit length. Even if you don’t owe anything it’s still reporting an on-time payment. You don’t need to hold a balance for them to report on time payments. You borrow $100 you pay $100. Although paying at least the credit card minimum will keep you in good standing with payment history.

Amounts Owed –

This shows the lender how much you owe relative to your accounts credit limit. For example let’s say you have a credit card with a $100 limit and owe $100. They don’t check the relative amount. They just check the proportions so to them you are maxed out and are a risk, even though $100 can be paid back easily.

This is why paying off your credit card 2-3 days before the statement date helps report a lower balance, although the minimum due date is usually 2-3 days before the statement date for most credit cards anyways. Make sure you pay ON or BEFORE your due date to avoid missing a payment.

On the statement date (after your payment due date) your credit card sends your balances, credit limit and payment information to the 3 bureaus, and doing this successfully will report a $0 balance and an on time payment.

Having $0 balances every month doesn’t guarantee perfect credit! You most likely will always have some balances left on your card since monthly statements overlap and you could have purchased something in between your payment due date and statement date. Just keep in mind the lower the number reported the better!

Length of Credit History –

Simply how long you’ve had the account open. This is why it’s important to keep your credit card accounts open and active. Research a credit card before you open it and make sure you can fit it into your life to avoid having an account get closed, and your average credit history drop.

A simple solution to a credit card you don’t use much, you can always set it to pay a recurring subscription or bill, then set the credit card to autopay the statement balance every due date. Keeps your account active, and your history going.

If you have a credit card you don’t use anymore and it’s charging you an annual fee, you might have to think about the benefits (if any) it’s brining to you and consider closing it now before more damage is done to your credit.

Credit Mix –

This shows you’re a responsible borrower all around. Having multiple lines of credit with different purposes shows you can be trusted with paying back multiple types of accounts. This is the lowest factor of scoring but sometimes lenders just want to see a good mix.

Having 2 credit cards doesn’t count as mix, since they are in the same category of borrowing. Although better than having one since having more credit than what you owe is a good sign of a responsible borrower. What a lender wants to see is for example credit cards, personal loans, auto loans, and mortgages. These are all considered mixed. Also remember to keep in mind amounts owed, don’t get fed up with mixing that you forget about proportions.

Having all of them is not required. You can still have a good score while not having a variety of credit. Since the other factors weigh more than just credit mix.

New Credit –

Used for keeping track of new accounts you open. Opening too many accounts in a row is considered risky and can affect your score. Also applying for new credit sometimes generates what’s called a “hard inquiry” which can stay on your credit report for up to 2 years. Sometimes can affect you negatively if you’re requesting too many hard inquires.

Your score will be affected with new credit. Opening a new account will lower your average credit age. The effects won’t last long as your score will recover after making some on time payments and having more available credit than debt.

This is why mortgage lenders usually tell you to avoid opening new lines of credit while applying for a mortgage. You don’t want to affect your score negatively and risk getting denied for a mortgage.

Bottom Line

Your credit score is widely affected by many things, but the most important ones are; Age, Payment History, and Balances.

Keep your old accounts, pay them on time, and don’t use too much of your credit limit to keep your score in shape.

If you’re interested in learning more about credit you can check out my other chapters on debt, how to use credit cards, and the truth behind minimum payments.

Thank you for reading and see you next Sunday,

– Pablo