What is Debt Consolidation?

Sometimes, depending on your situation miscellaneous amounts of debt rack up through various sources. Too much and it can get pretty overwhelming. Don’t get me wrong, having multiple sources of credit is a good thing. This proves to your credit bureaus that you’re a reliable borrower. That’s if you make at least your minimum payment on time.

If having multiple lines of credit makes you a more reliable borrower, what about having a good relationship with your bank or credit union? If you already have a good credit score, they can offer you discounted APR loans which you can help you pay back other higher interest debts.

Remember having multiple lines of credit is a good thing, not having multiple BALANCES. This is what we’re trying to avoid.

Personal Loans

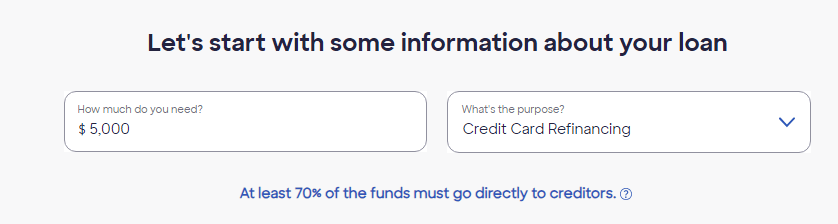

Personal loans can be a great way to consolidate your debt. They are flexible with terms and you can see upfront how much your payment will be and forecasted interest. You can always shop around for these as well. Many will ask what the purpose of the loan is for and for debt consolidation many loan companies require direct payment to other creditors. This means that most of the time they will not give you cash directly.

From Discover Personal Loan Website

Adding a personal loan to your credit history also improves credit diversity, and if done successfully you can boost your credit score just by making on time payments and paying off the loan. This alongside with possibly less interest and less stress on you for payments.

Consolidating your 5 credit cards into 1 monthly payment can improve budgeting drastically. Don’t consolidate with the sole intention of emptying out your credit cards so you can go spend with them again. This is to help you get out of the cycle, if you feel like you cannot do this. DO NOT CONSOLIDATE.

Balance Transfers

Balance transfers are for utilizing your already open line of credit to pay off other credit cards. Kind of like paying off a credit card with a… credit card. This can be very beneficial since usually you would transfer balances from a higher interest rate credit card to a lower rate credit card. These transfers usually incur fees, starting at 3% of the transferred balance.

This can also be great if you want to move all your balances to one card and only focus on one payment instead of multiple a month. Keep in mind unless otherwise stated in the transfer terms all balances will incur fees, and applicable interest charges. So make sure you’re doing the math to see that the fee will cost you lower than the interest saved in the long run!

Check your mail and E-mail. Interest saving offers will be sent to you periodically and if you have good credit these may be worth looking at. They can save you thousands of dollars on interest a year (if used correctly).

An additional benefit to this is that you don’t need additional credit checks since it uses your current line of credit. This can save you from hard inquires which take up to 2 years to clear off your credit report!

Debt Settlement/Forgiveness

This process can take years if not even worsen your current situation. You find a company that will help your reduce, settle, or forgive your debt. They will act on your behalf and negotiate with creditors to reduce or forgive debt.

What is debt forgiveness and how does it work?

When you find a settlement company they will act on your behalf to help you reduce your unsecured debt. Usually they will ask you to stop paying back your creditors to start the process. This can lead to huge fees coming from your credit card company due to penalty APR and late fees. Not to mention all the interest that accumulates while you wait to settle.

This service is not free. Usually settlement companies will charge fees as well. Sometimes they even charge you based on how much debt the were able to reduce. If they successfully do reduce some debt, any forgiven debt is also taxable. (thanks IRS!)

What happens if they weren’t able to negotiate my debt down?

You still have to pay back your creditor the money you owe. This on top of whatever fees you incurred with the settlement company as well. This can overall worsen the situation if you were already struggling to begin with.

You can always settle by yourself. Not drastically but you can start small. Creditors want to get paid back, and believe it or not interest rates, and other factors are negotiable. They can even pause your payments for a short period if you can prove you are struggling financially. Because ultimately your creditors’ goal is to get paid back.

Weighing Your Options

In the end you still need to pay back your debts. Make sure you take the option that benefits you the most! Look at all your interest rates, loan terms and conditions. You have the power to shop around! You can negotiate small things including interest rates with your current creditors. If you have a good relationship or a perfect payment history you can lower your interest rate by just asking them. Just remember that ultimately your creditor just wants to get paid back.

Thank you for reading and see you next Sunday,

– Pablo