The FIRE movement is an interesting topic that has been growing in popularity in the finance community. F.I.R.E stands for Financial Independence Retire Early, basically the path to early retirement. Brought to popularity by the Bogle Head Forums. The concept works by saying the more money you put aside, the faster you’ll be able to retire. For example if you can theoretically live on the bare minimum on $30k while earning $80k a year. You can save $50k a year (63%) of your income. If you keep this up while consistently saving and investing you’d be able to retire in about 11 years. Crazy to think that in only 11 years you can have all the freedom and independence you want. Although this is an extreme sacrifice one must make for 11 whole years before they reap any rewards.

Just 1 More Dollar

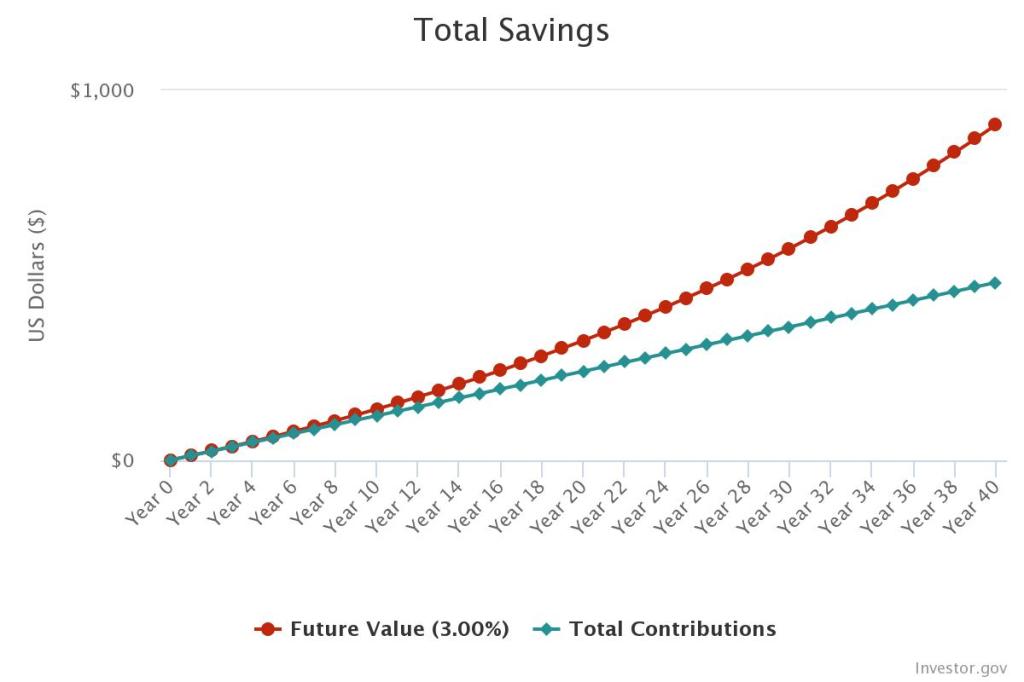

Contributing just $1 a month for 40 years at an average 3% interest can result in $908. Average stock market returns are 7% per year. Now imagine what an extra $100 a month can do for you.

How To Get Started

Now that you see the power of compound interest working with a single dollar, you see that it is certainly possible with any amount of money. You just have to be realistic about what lifestyle you’re going to want in retirement. You need to start by finding your FIRE number. To calculate this number you’re going to need to know

- The Rule of 25

- 4% rule

- Your Savings Rate

Let’s say your goal income is 50,000 a year. With the rule of 25 you take your goal income and multiply it by 25. That leaves you with a FIRE number of 1.25M.

Now with the 4% rule it’s 4% * Your FIRE Number. The rule is, you shouldn’t pull out more than 4% of your principle since you’ll be more likely to run out of money. The 4% rule only really works if you plan on living on your principle for about 30 years. There are ways to invest so you don’t have to pull out any of your principle investment but those usually require more capital.

Your savings rate is calculated by how much you can realistically save every year from your income. The more you increase your savings rate, the less time it will take you to reach your FIRE number. You can play around with these numbers for your particular situation here. This calculator will tell you realistically what year you will retire in and how much money you should have theoretically saved by then.

Getting Serious

Now that you see all the possibilities on retiring early, you need to know what steps to take to get there. Here’s what I recommend if you’re starting your FIRE journey.

If you have a job with a 401k(k) match, make sure you’re taking advantage of it.

Pay off any debts that aren’t a mortgage. Compound interest won’t help you if you’re getting eaten alive by 20%+ interest debts.

Open a ROTH IRA account and contribute a consistent amount every month. Remember not to pass the IRS limits!

Saving more will get you to your goal faster. If you can’t spend any less find ways to make more.

Bottom Line

The journey to an early retirement is not that difficult. Your goals and aspirations may change every year and saving might be easier one year and more difficult another year. What matters is that you’re saving every year. The fun is always in the journey not the destination! Just remember, you’re playing with FIRE so don’t get burned!

Thanks again for reading and see you next Sunday,

– Pablo